We are your access to digital asset investment services – Active management, algorithmically enabled. Advanced. Secure. Transparent.!

Futures trading involves buying or selling a contract that obligates the trader to purchase or sell an asset—like Bitcoin or Ethereum—at a predetermined price on a future date. Instead of owning the actual cryptocurrency, you’re trading based on its future price movement. This allows traders to speculate on whether the price will rise or fall and potentially profit either way. It’s a powerful tool used by both investors and institutions to manage risk or seek returns from short-term price changes.

One of the key features of futures trading is leverage—the ability to control a large position with a relatively small amount of capital. This amplifies both potential profits and losses, making risk management essential. Traders can go long (betting the price will go up) or short (betting it will go down), which provides flexibility in any market condition. Futures markets are also highly liquid, meaning trades can be executed quickly and efficiently, especially in the crypto space.

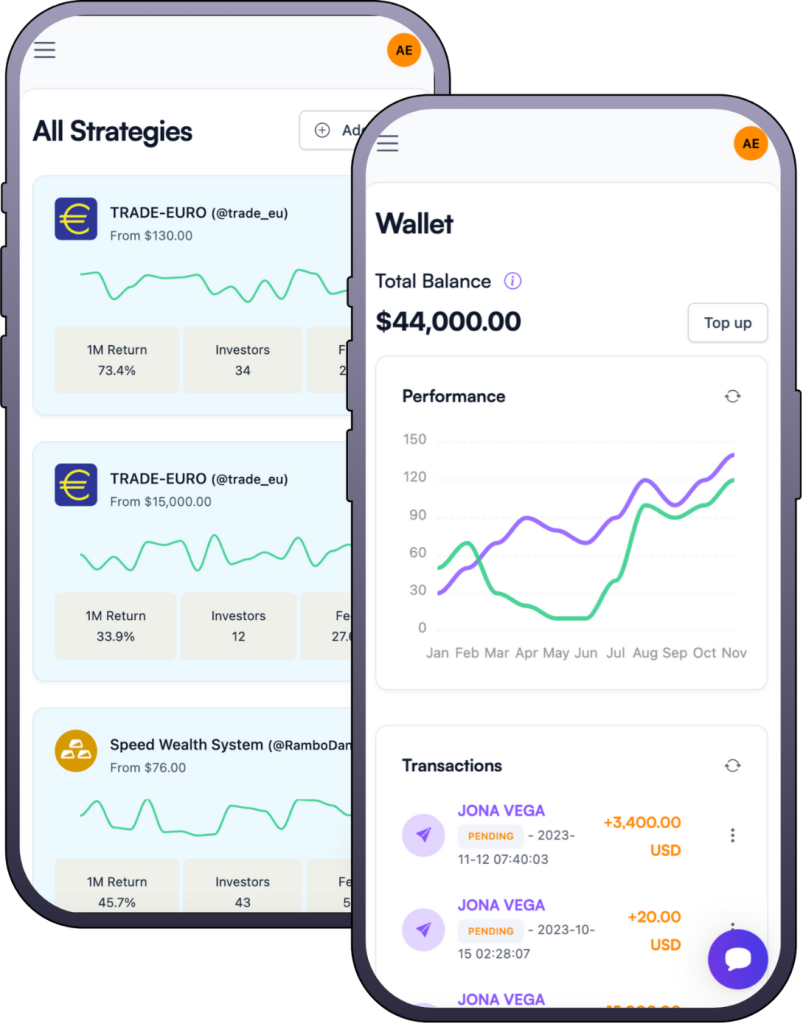

At Peak Edge Trading, we simplify this process by providing a secure platform, expert guidance, and strategic plans tailored to different risk levels. Our investment committee carefully analyzes market trends, helping you make informed decisions. Whether you’re a beginner or a seasoned trader, our tools and resources empower you to take advantage of futures trading with confidence.

* We will not share your personal information with anyone